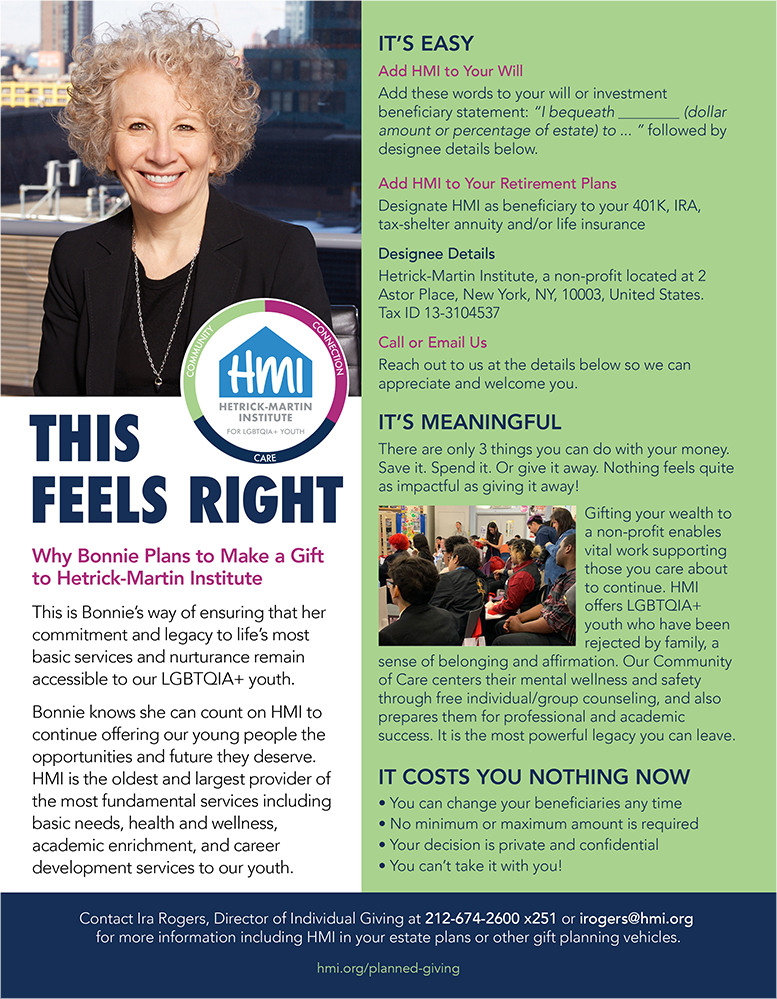

PLANNED GIVING

Through HMI’s Planned Giving initiative, HMI will work with each individual to create a personalized road map of donation opportunities throughout their life. Whether you’re a young professional out of college, a happy couple registering with HMI Do in honor of your special day, volunteering your time and talents, or including HMI in your estate planning leaving, HMI can engage and assist you throughout your life, through its Planned Giving program, to make a more substantial and sustainable impact for LGBTQIA+ youth.

Wills and Estates

One of the most common options is naming HMI as beneficiary in your will or living trust to receive a percentage or set dollar amount of your estate upon your death. You may also leave a specific item or a gift contingent on certain events or conditions.

Retirement Plan Assets

Another common option is designating HMI as the beneficiary of your retirement plan contributions. This includes tax-deferred accounts such as a 401K employee retirement plan, IRA or tax-sheltered annuity. The benefit is HMI will receive the entire amount you give without having to pay taxes on it because it is a nonprofit organization.

Gift of Life Insurance

If you own a paid-up life insurance policy and no longer need the coverage, you can transfer ownership of the policy to HMI. HMI can elect to surrender the policy for cash or keep the policy and receive the death benefits later on. Either way, you will receive an immediate income tax deduction for the cash surrender value of the policy. If you are not ready to transfer the ownership of your life insurance policy, another alternative is to name HMI as the beneficiary at your death. Including HMI as death beneficiary will not affect your ability to access the cash value of the policy during your life.

Employee Giving

Sign up to be come an HMI Sustainer where you can set up automatic monthly giving for as little as $25.

Please let us know if you would like to include HMI in your estate plans. Members receive special recognition, as well as invitation to donor events and programs. Plus, your participation will inspire others to create future gifts and add their names to the growing roster of Planned Giving members.

Partner with HMI to Create a Lifetime of Impact

Your legacy is a reflection of who you are, how you loved, what you accomplished, how you gave.

With your gift, you will ensure that HMI will continue to provide ongoing life-saving services. Leave a lasting mark.

Click to download PDF

For more information about Planned Giving, including HMI in your estate plans or other gift planning vehicles, please contact Ira Rogers, Senior Director, by email or phone at 212-674-2600 x251.

Hetrick-Martin Institute is a 501(c)(3), tax-exempt organization. Our EIN is 13-3104537.